About Dividends

Dividend Policy

As of June 26, 2025

The Company (hereinafter, simply "we") treats goodwill and intangible assets as risk assets under financial discipline, and shall keep them within the scope of shareholders' equity. We will expand shareholders' equity through cash flow from operating activities while securing investment capacity for future M&A. By setting dividend levels based on this shareholders' equity, we aim to achieve a balance between investment and returns. Specifically, we have established a new dividend policy with a DOE of 3.6% and a minimum payout ratio of 15%.

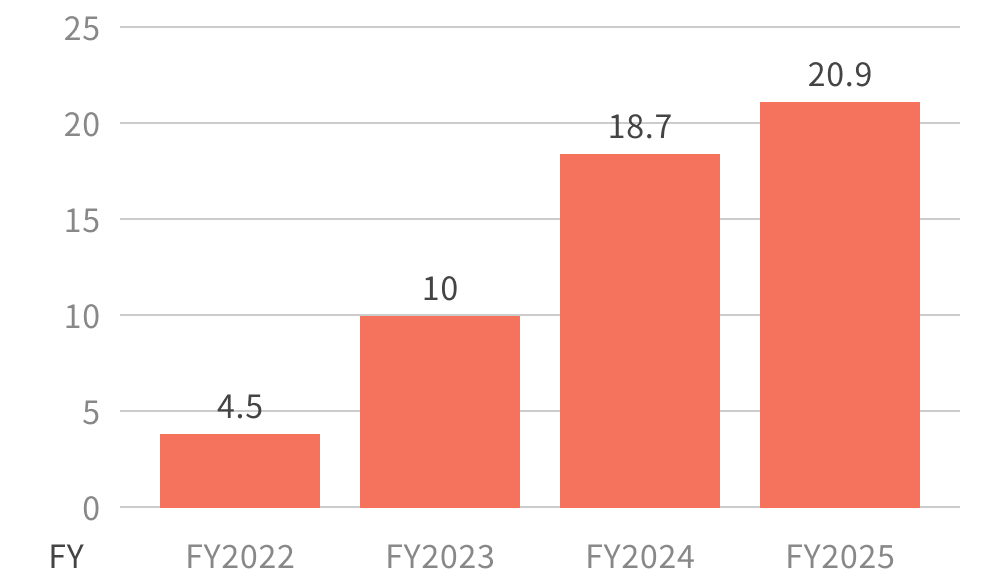

Under this basic policy, the year-end dividend for the fiscal year ended March 2025 was set at a regular dividend of 20.9 yen. Furthermore, for the fiscal year ending March 2026, we plan to set the year-end dividend at 23.0 yen per share, assuming we can secure the projected profits.

The distribution of our retained earnings is based on the last day of the fiscal year, with the decision-making body being the Board of Directors.

Additionally, our Articles of Incorporation stipulate that, based on Article 454, Paragraph 5 of the Companies Act, we can pay interim dividends with September 30 as the record date each year, by resolution of the Board of Directors.

Dividend Trends

Dividend Payment Record Date

March 31

For interim dividends, the record date for dividend payment is September 30.

*Payments will be made to shareholders listed or recorded in the final shareholder register as of March 31 and September 30.

To Receive Dividend

Information on how to receive dividends is provided on the Mizuho Trust & Banking Co., Ltd. website.