Corporate Governance

Basic Concept of Corporate Governance

In the future, it is predicted that Japan will become a super-aged society unprecedented in the world, with about 1 in 2.4 people being 65 years or older by 2070.

In such an environment, CHANGE Group (hereinafter, "our Group" or simply "we") has set the mission of "Change People, Change Business, Change Japan," and under the vision of "Change productivity," we are developing businesses to make Japan a sustainable society amid a declining population.

We believe that to achieve our mission, it is important not only to strive for transparency in management and business execution but also to fulfill corporate accountability by appropriately explaining and disclosing the status of corporate governance and compliance, thereby meeting the expectations of stakeholders, including shareholders, customers, business partners, employees, and local communities.

We will continue to utilize the Corporate Governance Code as a tool to ensure that these mechanisms are moving in the right direction, and we will work on the continuous enhancement and further deepening of corporate governance.

Corporate Governance System

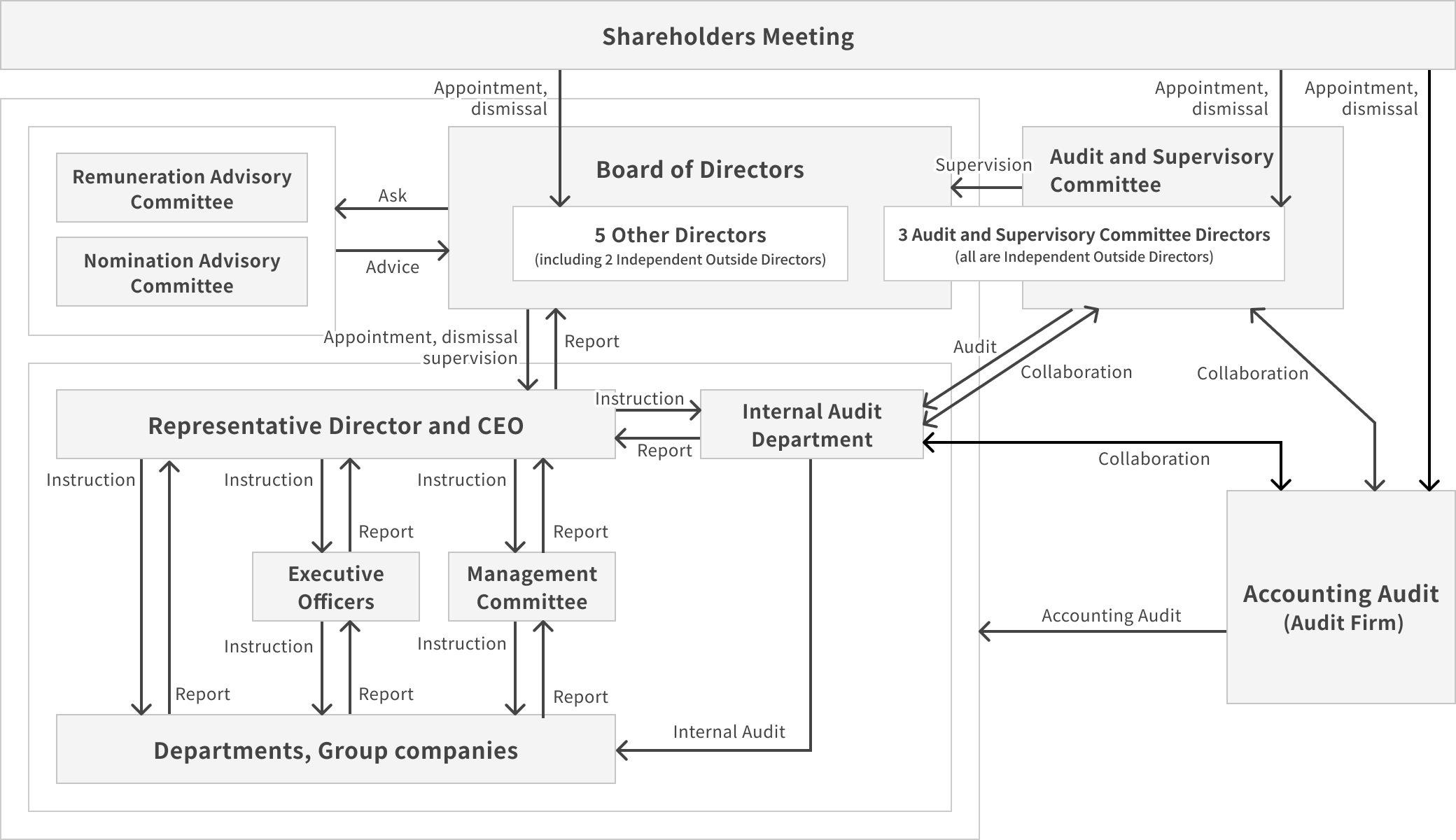

Corporate Governance System/Structure Chart

Our corporate governance system is as follows.

Board of Directors

Overview of the Board of Directors

Our Board of Directors consists of 8 members: 5 Directors (excluding Directors who belong to the Audit and Supervisory Committee, 2 of whom are Independent Outside Directors) and 3 Directors who belong to the Audit and Supervisory Committee (hereinafter, the Audit and Supervisory Committee Directors) (all of whom are Independent Outside Directors). We have established a decision-making body that can quickly respond to environmental changes, thereby organizing a business execution supervision system and ensuring fairness in decision-making. Additionally, to ensure the objectivity and neutrality of management oversight functions, the majority of our Directors are Outside Directors.

The Board of Directors holds regular monthly meetings, as well as quarterly meetings related to financial results, and convenes extraordinary meetings as necessary to make important decisions regarding management and business execution. Main agenda include matters related to management and business plans, matters concerning officers, financial matters, and issues related to compliance, risk management, and governance.

According to our Articles of Incorporation, the number of Directors (excluding the Audit and Supervisory Committee Directors) shall not exceed 7, and the number of the Audit and Supervisory Committee Directors shall not exceed 5. Furthermore, the resolution for their appointment is made at the general meeting of shareholders, where shareholders holding at least one-third of the voting rights shall be present, and it shall be decided by a majority of the voting rights, without cumulative voting.

Established Regulation

We have established the Board of Directors' Regulation to clarify matters related to the operation of the Board of Directors and to ensure the legality and transparency of its proceedings.

Details of the Board of Directors

Regarding the size of the Board of Directors, our basic concept is to have a sufficient and appropriate number of members to conduct thorough discussions. Currently, our Board of Directors consists of 3 Internal Directors and 5 Independent Outside Directors (3 of whom are the Audit and Supervisory Committee Directors), making a total of 8 Directors, with 5 being Independent Outside Directors. The number of annual meetings and attendance for the fiscal year ending March 2025 is as follows:

| Name | Gender | Category | Position(*) | Board of Directors | ||||

|---|---|---|---|---|---|---|---|---|

| Male | Female | Re-ap | New | Independent Outside |

Attendance | Ratio | ||

| Hiroshi Fukudome | ○ | ○ | Representative Director, President and Executive Officer | 19 | 19/19 | |||

| Akira Ito | ○ | ○ | Director, Executive Officer and Vice President | 19/19 | ||||

| Yutaka Yamada | ○ | ○ | Director, Executive Officer and CFO | 19/19 | ||||

| Takeshi Matsumoto | ○ | ○ | Independent Outside Director | ○ | 19/19 | |||

| Kayo Takigawa | ○ | ○ | Independent Outside Director | ○ | 19/19 | |||

| Takehiko Kubo | ○ | ○ | Outside Director (Audit and Supervisory Committee Director) (fulltime) | ○ | 19/19 | |||

| Hiroyuki Yaji | ○ | ○ | Outside Director (Audit and Supervisory Committee Director) (parttime) | ○ | 19/19 | |||

| Ryuzo Koide | ○ | ○ | Outside Director (Audit and Supervisory Committee Director) (parttime) | ○ | 19/19 | |||

Skill Matrix

From the perspective of enhancing corporate value in the medium to long term, our Board of Directors strives to optimize knowledge, experience, ability, and diversity as a whole.

Currently, our Board of Directors is composed of Directors familiar with each department and Outside Directors with high expertise, and we believe that as a whole, it maintains a sufficient skill set and diversity.

We disclose a list of the skills possessed by each Director (skill matrix).

| Name | Position(*) | Gender | Skill | |||||

|---|---|---|---|---|---|---|---|---|

| Corporate Management /Management Strategy |

IT/DX | Investment /M&A | Accounting /Finance | Human Resource Develop ment/ Diversity | Legal /Compli ance /Risk Manage ment | |||

| Hiroshi Fukudome | Representative Director, President and Executive Officer | Male | ○ | ○ | ○ | ○ | ||

| Akira Ito | Director, Executive Officer and Vice President | Male | ○ | ○ | ○ | ○ | ||

| Yutaka Yamada | Director, Executive Officer and CFO | Male | ○ | ○ | ○ | ○ | ||

| Takeshi Matsumoto | Independent Outside Director | Male | ○ | ○ | ○ | ○ | ||

| Kayo Takigawa | Independent Outside Director | Female | ○ | ○ | ○ | |||

| Takehiko Kubo | Audit and Supervisory Committee Director (fulltime) | Male | ○ | ○ | ○ | ○ | ||

| Hiroyuki Yaji | Audit and Supervisory Committee Director (parttime) | Male | ○ | ○ | ○ | |||

| Ryuzo Koide | Audit and Supervisory Committee Director (parttime) | Male | ○ | ○ | ○ | ○ | ||

Status of Important Concurrent Positions

As of the end of December 2024, the status of important concurrent positions of our Internal Directors is as follows:

| Position | Name | Responsibilities and Status of Important Concurrent Positions |

|---|---|---|

| Representative Director, President and Executive Officer | Hiroshi Fukudome | Director of TRUSTBANK, Inc. Outside Director of ROXX Co., Ltd. Director of Orb, inc. Advisory of PORT INC. President and Representative Director of SBI Regional Revitalization Services, Inc. Director of Govmates, Inc. Director of DFA Robotics, Inc. Director of Travel Zip, Co.,Ltd. Outside Director of HOPE, INC. Outside Director of CHANGE Kagoshima, Inc. Director of E-Guardian Inc. Director of CyLeague Holdings, Inc. Outside Director of A-shal Design Co., Ltd. Director of fundbook, inc. Executive Director of NASCON Valley Council |

| Director, Executive Officer and Vice President | Akira Ito |

Executive Vice President and Director of beacapp Inc. Director, Executive Officer and Vice President of CHANGE, Inc |

| Director, Executive Officer and CFO | Yutaka Yamada | Director of TRUSTBANK, Inc. |

Promotion of Gender Diversity

We recognize that it is important to work on improving diversity in the Board of Directors to further enhance the quality of management decision-making. Based on this recognition, we appointed our first female officer (Outside Director) at the 17th Annual General Meeting of Shareholders held on December 18, 2019, and appointed another female Director (Outside Director) at the 21st Annual General Meeting of Shareholders held on June 27, 2023.

Currently, the ratio of female officers in the Company is 12.5%, and we aim to continue improving the ratio of female members on the Board of Directors.

Summary of Deliberations on Conflicts of Interest

We recognize that when transactions are conducted where the interests of Directors conflict with those of the Company, or when there is a possibility of such, there is a risk that Directors may use their positions to benefit themselves or third parties at the expense of the Company's interests.

Therefore, in accordance with the provisions of the Companies Act, we resolve such transactions at the Board of Directors when the interests of Directors conflict with those of the Company.

Furthermore, during the deliberation process, we actively seek opinions from Outside Directors and Outside Auditors from an objective standpoint to supervise the execution of operations that may involve conflicts of interest.

Summary of Deliberations on Related Party Transactions

Since 2020, we have been conducting annual analysis and evaluation of the effectiveness of the Board of Directors. The evaluation method involves conducting 30-item signed questionnaires targeting all members of the Board of Directors, including Outside Directors (including those who are Audit and Supervisory Committee Directors). Based on the aggregated and analyzed results, the Board of Directors deliberates on the issues to be addressed in the future. We also disclose the evaluation results in the Corporate Governance Report.

Audit and Supervisory Committee

Overview of the Audit and Supervisory Committee

Our Audit and Supervisory Committee consists of 3 members: 1 full-time Director who is the Audit and Supervisory Committee Director and 2 Directors who are also the Audit and Supervisory Committee Directors (all of whom are Independent Outside Directors), and it audits the execution of duties by Directors (excluding the Audit and Supervisory Committee Directors) as an independent body entrusted by shareholders. Specifically, through attendance at important meetings such as the Board of Directors and effective collaboration with the Internal Audit Department, the committee conducts investigations into the Company's business and financial status and verifies the content of reports received from Directors (excluding the Audit and Supervisory Directors), employees, and the Accounting Auditor. Additionally, when deemed necessary, the committee reports, proposes, expresses opinions, or provides advice and recommendations to the Board of Directors or to Directors (excluding the Audit and Supervisory Committee Directors) or the Internal Audit Department, striving to establish a high-quality corporate governance system and fulfilling its supervisory and audit functions over management.

Established Regulation

We have established the Audit and Supervisory Committee Regulation to clarify matters related to the operation of the Audit and Supervisory Committee and to ensure the legality and transparency of its proceedings.

Details of the Audit and Supervisory Committee (Board of Auditors)

Since we transitioned to the Company with the Audit and Supervisory Committee in June 2025, the number of annual meetings and attendance of the Board of Auditors for the fiscal year ending March 2025 is as follows:

| Name | Gender | Category | Position(*) | Board of Directors | ||||

|---|---|---|---|---|---|---|---|---|

| Male | Female | Re-ap | New | Independent Outside |

Attendance | Ratio | ||

| Takehiko Kubo | ○ | ○ | Outside Auditor (fulltime) | ○ | 12 | 12/12 | ||

| Hiroyuki Yaji | ○ | ○ | Outside Auditor (parttime) |

○ | 12/12 | |||

| Ryuzo Koide | ○ | ○ | Outside Auditor (parttime) |

○ | 12/12 | |||

Advisory Committee

Overview of the Advisory Committee

To ensure the independence and objectivity of the Board of Directors' functions related to the nomination of Directors (including succession planning), we have established the "Nomination Advisory Committee" as an advisory body to the Board, with a majority of its members being Independent Outside Directors (composed of the Representative Director, President and Executive Officer, and two Independent Outside Directors, totaling three members). The Nomination Advisory Committee deliberates on matters related to the appointment, reappointment, and dismissal of Directors, as well as the succession plan for the Representative Director (including development), and makes recommendations to the Board of Directors.

- The Nomination Advisory Committee: To enhance the independence and objectivity of the Board of Directors' functions related to the nomination of Directors (including succession planning) and accountability, we have established the Nomination Advisory Committee as an advisory body to the Board of Directors, with a majority of its members being Independent Outside Directors. The Nomination Advisory Committee consists of three members: the Representative Director, President and Executive Officer, and two Independent Outside Directors. It deliberates on matters related to the appointment, reappointment, and dismissal of Directors, as well as the succession plan for the Representative Director (including development), and makes recommendations to the Board of Directors, as necessary. Furthermore, we have established the Nomination Advisory Committee Regulation that clearly defines its position and operational methods.

- The Remuneration Advisory Committee: To ensure the independence and objectivity of the Board of Directors' functions related to Director's compensation, we have established the Remuneration Advisory Committee as an advisory body to the Board of Directors, with a majority of its members being Independent Outside Directors. The Committee consists of three members: the Representative Director, President and Executive Officer, and two Independent Outside Directors. The Remuneration Advisory Committee deliberates on policies related to determining individual Director compensation (including the selection of indicators for performance-based compensation and criteria for granting share-related compensation) and the content of individual Director's compensation, and makes recommendations to the Board of Directors.

Details of the Advisory Committees

The number of annual meetings and attendance for 2024 is as follows:

| Name | Gender | Position | Nomination Advisory Committee *1 | Remuneration Advisory Committee *2 | ||||

|---|---|---|---|---|---|---|---|---|

| Male | Female | Independent Outside | Chairman | Attendance ratio | Chairman | Attendance ratio | ||

| Hiroshi Fukudome | ○ | Representative Director, President and Executive Officer | ○ | 2/2 | ○ | 2/2 | ||

| Takeshi Matsumoto | ○ | Outside Director | ○ | 2/2 | 2/2 | |||

| Kayo Takigawa | ○ | Outside Director | ○ | 2/2 | 2/2 | |||

*2. Held on May 9, 2024, and May 22, 2024

General Meeting of Shareholders

One Share, One Vote Principle

The Company adheres to the provision of the Companie Act that shareholders must be treated equally according to the content and number of shares they hold (one share, one vote principle), and applies this principle to general meetings of shareholders and other occasions.

Ensuring the Number of Days from Dispatch of Notice to the Date of the General Meeting

We strive to send notices early to ensure sufficient time for consideration in exercising voting rights. The notice of convocation for the Annual General Meeting of Shareholders for the fiscal year ending March 2025 (held on June 26, 2025) was published on the Company's website, including an English translation, on June 5, 2025, and dispatched on June 9, 2025.

Furthermore, we ensure sufficient time for consideration of the agenda by enabling voting rights to be exercised via the internet, including the electronic voting platform for institutional investors operated by ICJ, Inc.

Details of Exercising Voting Rights

Results of Shareholders' Exercise of Voting Rights at the Annual General Meeting of Shareholders held on June 26, 2025

| Resolution Matters | In Favor (Units) | Against (Units) | Abstentions (Units) | Approval Requirements | Resolution Results and Approval Ratio (%) (Note4) |

|---|---|---|---|---|---|

| Proposal No. 1 | 508,992 | 2,491 | 0 | (Note) 1 | Approved 99.41 |

| Proposal No. 2 | 486,272 | 25,211 | 0 | (Note) 2 | Approved 94.97 |

| Proposal No. 3 Hiroshi Fukudome Akira Ito Yutaka Yamada Takeshi Matsumoto Kayo Takigawa |

502,573 506,625 506,685 507,098 506,407 |

8,910 4,858 4,798 4,385 5,076 |

0 0 0 0 0 |

(Note) 3 | Approved 98.16 Approved 98.95 Approved 98.96 Approved 99.04 Approved 98.91 |

| Proposal No. 4 Takehiko Kubo Hiroyuki Yaji Ryuzo Koide |

494,708 476,133 508,430 |

16,775 35,350 3,053 |

0 0 0 |

(Note) 3 | Approved 96.62 Approved 92.99 Approved 99.30 |

| Proposal No. 5 | 506,187 | 5,271 | 25 | (Note) 1 | Approved 98.86 |

| Proposal No. 6 | 506,980 | 4,478 | 25 | (Note) 1 | Approved 99.02 |

1. Approved by a majority of the voting rights of shareholders who are present and are entitled to exercise their voting rights.

2. Approved by two-thirds or more of the voting rights of shareholders entitled to exercise their voting rights, having at least majority of the voting rights, attending at the General Meeting of Shareholders.

3. Approved by majority of the voting rights of shareholders entitled to exercise their voting rights, having at least one-third of the voting rights, attending at the General Meeting of Shareholders.

4. The approval ratio is recorded by truncating the decimal point from the third decimal place onward.

Audit Firm

Overview of the Company's Accounting Auditor (Audit Firm)

Based on the evaluation by the Audit & Supervisory Board (ensuring that the Accounting Auditor possesses the required expertise, audit quality, and independence, and that a system is in place to ensure that the Company's accounting audits are conducted properly and appropriately, in addition to having a specific audit plan and reasonable and appropriate audit fees, and through daily audit activities, communication with management, Auditors, the Accounting Departments, and the Internal Audit department, as well as appropriate group-wide audits and responses to fraud risks), we have selected Ernst & Young ShinNihon LLC as the Accounting Auditor.

Furthermore, regarding the amount of compensation for the Accounting Auditor, the Audit & Supervisory Board conducts necessary verification to ensure that the content of the audit plan, the status of the execution of accounting audit duties, and the basis for calculating the fee estimates are appropriate and obtains the consent of the board.

The overview of audit fees for the Accounting Auditor is as follows:

| FY2021(ended Sept.) | FY2022(ended Mar.) | FY2023(ended Mar.) | FY2023(ended Mar.) | |||||

|---|---|---|---|---|---|---|---|---|

| Fees Based on Audit and Attestation Services (Million Yen) | Fees Based on Non-Audit Services (Million Yen) | Fees Based on Audit and Attestation Services (Million Yen) | Fees Based on Non-Audit Services (Million Yen) | Fees Based on Audit and Attestation Services (Million Yen) | Fees Based on Non-Audit Services (Million Yen) | Fees Based on Audit and Attestation Services (Million Yen) | Fees Based on Non-Audit Services (Million Yen) | |

| Company | 56 | 18 | 44 | - | 65 | - | 81 | - |

| Consolidated subsidiaries | - | - | - | - | - | - | - | - |

| Total | 56 | 18 | 44 | - | 65 | - | 81 | - |

Approach to Executive Compensation

Process for Determining Compensation Amounts

1. Policy on Determining the Amount and the Calculation Method of Executive Compensation

(a)Method for Determining the Policy

The Company resolved the policy for determining individual Director's compensation at the Board of Directors meeting held on December 15, 2020.

Prior to the resolution of the Board of Directors, the content to be resolved was consulted with the Remuneration Advisory Committee, and recommendations were received.

Additionally, at the Board of Directors meeting held on December 24, 2021, a resolution was made to change the policy on performance-based compensation to use only the current profit attributable to owners of the parent company (consolidated performance) as the indicator for performance-based compensation from the fiscal year ended March 2022 onward.

(b)Overview of the Policy Content

Details are disclosed in the following sections of the Corporate Governance Report. [Disclosure Based on Each Principle of the Corporate Governance Code] [Principle 3-1] (3) Policy and Procedures for the Board of Directors in Determining Compensation for Executive Management and Directors

(c) Reason the Board of Directors Determined that the Content of Individual Director

Compensation Aligns with the Policy

The Board of Directors has confirmed that the method for determining the content of individual Director's compensation and the content of the determined compensation aligns with the decision policy resolved by the Board of Directors, and that the recommendations from the Remuneration Advisory Committee are respected, and thus determined that it aligns with the policy.

(d) Shareholders' Meeting Resolution on Executive Compensation

At the Annual General Meeting of Shareholders held on June 26, 2025, the Company transitioned from the Company with the Board of Auditors to the Company with the Audit and Supervisory Committee.

After transitioning to the Company with the Audit and Supervisory Committee, it was resolved that the total amount of compensation for all Directors (excluding the Audit and Supervisory Committee Directors) shall be within 500 million yen per year, and the total amount of compensations for all the Audit and Supervisory Committee Directors shall be within 50 million yen per year.

The resolution details regarding Director's compensation at the shareholders' meeting before transitioning to the Company with the Audit and Supervisory Committee are as follows:

The total amount of Directors' compensation of the Company was resolved to be within 500 million yen per year at the 18th Annual General Meeting of Shareholders held on December 25, 2020. At the conclusion of

the shareholders' meeting, the number of Directors was six (including two Outside Directors).

The total amount of compensation for Auditors was resolved to be within 30 million yen per year at the 12th Annual General Meeting of Shareholders held on December 19, 2014. At the conclusion of the shareholders' meeting, the number of auditors was two.

(e) Method for Calculating Performance-Based Compensation

Before transitioning to the Company with the Audit and Supervisory Committee, the performance-based compensation for the fiscal year ended March 2025 was calculated and the payment amount was determined and paid based on the following method after the performance indicator values were confirmed:

a. Total Payment Amount

The total payment amount is the sum of the individual payment amounts in b.(i) below (with a maximum limit of 85,000,000 yen).

b. Individual Payment Amount

The specific calculation formula for the individual payment amount is as follows.

(i) Performance-Based Compensation Based on Consolidated Performance

Performance Indicator: Current Profit Attributable to Owners of the Parent Company Before Performance-Based Compensation

Total Payment Amount for Performance-Based Compensation Based on Consolidated Performance =B×C

A = Current Profit Attributable to Owners of the Parent Company Before Performance-Based Compensation for the Fiscal Year Ended March 2025 (Actual Value) ÷ Current Profit Attributable to Owners of the Parent Company for the Fiscal Year Ended March 2025 (Target Value: 8,069,459,551 yen)

B=5,000,000 million yen

C = (A-1.00)×100 (Truncate decimal places. Set the upper limit to 17, and if negative, set to 0.)

Individual Payment Amount Calculation Base = Total Payment Amount for Performance-Based Compensation Based on Consolidated Performance × Position Points ÷ Total of Eligible Position Points

Position points are as follows:

| Representative Director, President and Executive Officer | Director, Executive Officer and Vice President | Director, Executive Officer and CFO |

|---|---|---|

| 50 | 25 | 25 |

| Performance Indicators | Target Value for the Fiscal Year ended March 2025 | Actual Value for the Fiscal Year ended March 2025 | Performance-Based Compensation Based on Consolidated Performance |

|---|---|---|---|

| Performance-Based Compensation Based on Consolidated Performance | 8,069 | 7,532 | 0 |

(f) Matters Related to the Authority to Determine the Amount of Executive Compensation

a. Amount of Director Compensation

The Company has established a Remuneration Advisory Committee as an advisory body to the Board of Directors. The Committee deliberates on the Director's compensation system and the amount of Director's compensation, and it is determined by a resolution of the Board of Directors. In the fiscal year ended March 2025, the Committee was held twice, and individual considerations by the members were conducted separately. The dates of the meetings are as follows:

- The 1st Remuneration Advisory Committee meeting will be held on May 9, 2024.

- The 2nd Remuneration Advisory Committee meeting will be held on May 22, 2024.

Additionally, during this period, two meetings were held as follows, with individual reviews conducted separately by the committee members.

- The 1st Remuneration Advisory Committee meeting will be held on May 12, 2025.

- The 2nd Remuneration Advisory Committee meeting will be held on May 20, 2025.

b. The amount of compensation for directors who are audit and supervisory committee members

The compensation amount for individual Audit and Supervisory Committee Directors is determined through discussions within the Audit and Supervisory Committee.

2. Total compensation by executive category for the fiscal year ended March 2024

| Executive category | Total compensation (million yen) | Total by type of compensation (million yen) | Number of eligible executives (persons) | ||

|---|---|---|---|---|---|

| Base compensation | Performance-based compensation | Non-monetary compensation, etc. | |||

| Directors (excluding Outside Directors) | 82 | 82 | - | - | 3 |

| Auditors (excluding Outside Auditors) | - | - | - | - | - |

| Outside Directors | 14 | 14 | - | - | 2 |

| Outside Auditors | 20 | 20 | - | - | 3 |

(Note) Contributions to defined contribution plan are included.

Long-term incentives

Regarding compensation linked to medium- to long-term performance, we believe that directors, excluding outside directors, currently hold sufficient company share, thus obtaining sound incentives for sustainable growth.